You must need to know how interest rate is calculated on your Provident Fund. First of all you should understand your contribution, your employer contribution and rate of interest to know the exact figure of your Employees’ Provident Fund.

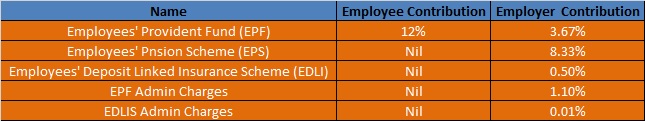

Employer and Employee Contribution in EPF

IF one has Basic plus Dearness Allowance is less than Rs. 15000 per month than the employer and employee contribution towards EPF will be same. The table will completely show how the contribution will be distributed if Basic +DA is less than or equal to Rs. 15000 pm.

One the other hand if Basic plus Dearness Allowance is more than Rs.15000 per month than one have to option to contribute in EPF or not. Whatever your employer may choose to contribute towards EPF but contribution towards EPS will remain same at 8.33% and other may change accordingly.

If Basic + DA is more than Rs.15000 pm the employer may contribute equally or restrict its share to Rs. 15000 pm and your to 12% of salary or he may restrict both your and his share to Rs. 15000 pm.

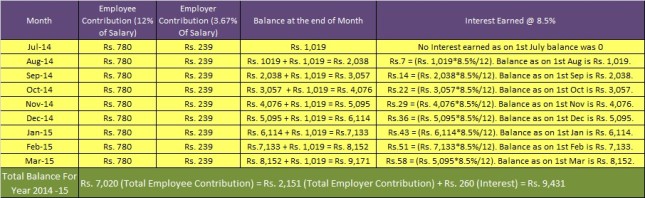

Interest Calculation on EPF

EPF financial year starts on 1st March and completes on 28th Feb (29th Feb in case of leap year). Interest is credited in account in April. Interest on EPF is compounded yearly but they use the “Average Monthly Balance” method for calculation.

k.kiran kumar pf accont number AP/KKP/0051519/000/0000255 IAM APPLYING FOR PF WITHDRAW BUT I AM NOT HAVING UAN NO AT THE TIME OF RESIGNING MY JOB AT APR-2014 HOW TO SUBMIT MY WITHDRAW FORM AT PF OFFICE AND HOW TO GET MY PF AMOUNT

Submit relevant Claim Forms duly attested by your ex-employer. No need for attestation if you have your UAN activated and linked to Bank Account & Aadhaar Card.

Read the Form filling instructions here and here carefully!

Sushpender, 9873441391, Ggn/28821/13666

STATUS for Member ID: GN/GGN/0028821/000/0013666 for M/s BHARTI RETAIL LTD.

UAN No is Mandatory Now! You should download this Android App EPF Balance UAN e-Sewa and get your UAN Registered and avail all facilities…

Your EPF balance has been sent through SMS on your specified mobile number. You shall receive the SMS shortly.

hi, mam myself manoj kewal actually after leaving my organisation from march 2015 still m unable to get my pf amount, org. says there is some issues regarding name and account number(pf) but its too long time to rectify this problem. please guide me that should i take any legal action on my previous organistion?pls. reply.

Thanks,

NAME – MANOJ KEWAL

ACC. NO. – DSNHP0033975000002212

CONT. NO. – 9971707972

STATUS for Member ID: DS/NHP/0033975/000/0002212

Your EPF balance has been sent through SMS on your specified mobile number. You shall receive the SMS shortly. UAN No is Mandatory Now! You should download this Android App EPF Balance UAN e-Sewa and get your UAN Registered.

Rohtash Kumar 9780515522 GJ RAJ 7850 67577

STATUS for Member ID: GJ/RAJ/0007850/000/0067577

Member name mismatch against this GJ/RAJ/0007850/000/0067577

TN/TRY/32956/228

What to do with this? Kindly reply!

VD/BRD/000/65682/000/0000045

Hi! What do you wanna know?