The employees, who have been contributing towards EPF account from their salary, may need to withdraw amount after leaving the job. If the employee withdraw EPF amount on or after 5 years and the total withdrawal is less than 30,000 INR, then there will be no TDS deduction on that money. But, if the employee withdraw EPF amount before 5 years and the amount is equal to or greater than 30,000 INR ], then the TDS will be deducted at source. However, TDS will be exempted in some cases also. Read Official TDS on PF Withdrawals Circular!

Is it compulsory TDS deduction on EPF Withdrawal amount before 5 years?

No. The TDS is not compulsory for all situations during withdrawal of EPF amount before 5 years. Let’s discuss some situations on which TDS won’t be applicable.

- 5 years can be counted including job period of 2 or more companies.

If an employee has opened PF account in previous company before 2 years and now he has been using the same PF no. in the existing company since last 3 years. Now, he needs to withdraw PF amount then your withdrawal amount will be TDS exempted because your EPF account has achieved 5 years.

For example: You have started an EPF account with your existing Employer in the Financial year 2015-16 and within 2 years your balance PF account is INR 30, 000/- in F.Y. 2017-18 and now you joined a new company and keep alive the same PF account with new company using UAN. Now, in new company, if you work for next 3 years than your PF account has completed 5 years in F.Y. 2020-21 and whatever granted amount you will withdraw will be tax exempted.

- Special cases such as ill health of employee

If the employee got serious illness and need money for treatment including insurance claim amount and the employee has opened PF account for 2 years only, then he can withdraw the balanced amount in PF account before 5 years with Tax exemption facilities.

- Business discontinuation of employer.

If the employer become defaulter or looser or business has been ceased by any Govt. department such as income tax or excise or quality control or Environment and pollution control department, then the employee can close the PF account and can withdraw the all balanced amount before 5 years with tax exemption facilities.

- If employee changed the job and transferred the balanced amount of existing EPF account to new EPF account of new company.

When the employee resign from the current job and join new company, he can close existing PF account no. and transfer the balanced amount to new PF Account no. maintained by new company. In this case, the transferred amount will be tax exempted and the service from previous establishment will be counted.

How many types of Provident funds available?

There are 4 types Provident funds available such as Statutory PF, Recognized PF, Unrecognized PF and Public PF.

- The Statutory PF was formed under PF Act, 1925 and this PF was maintained by Govt. and semi Govt. organizations, recognized education institutes, railways, universities, etc.

- The Recognized PF was formed under EPF and Miscellaneous PF Act, 1952. This is widely known as Employees’ Provident Fund and is applicable to organizations having 20 or more employee. And also the organizations having less than 20 employees can open PF account for their employees, if interested. The deposited amount of 12% on salary is exempted from Tax under section 80-C.

- The Unrecognized PF is not coming under 80-C and not recognized by commissioner of income tax. Here the employer’s contribution amount towards employee’s PF account is taxable.

- The Public Provident Fund (PPF) is established for beneficial of general public. Any public whether employee of company or self-employed person can participate in this PPF scheme. It is one of the beneficial income tax exemption schemes for all citizens of India.

Query -1: I joined a company on 15th August, 2009 and resigned from the company on 31st July, 2014 for any emergency situation. Further I could not continue job as well as EPF contribution, then if I withdraw PF amount, is it taxable?

Yes, it is taxable and if you don’t want it taxable, then you have to join with any company within next 3 years and complete the 5 years of PF account by contributing more PF amount from salary for 15 days and then your withdrawal amount will be tax free and your PF amount should be recognized by Commissioner of Income tax.

Query-2: Ramesh was working with Reliance Company for last 2 years from January, 2012 to December, 2014. Now he has resigned from that company and he wants to withdraw the PF amount. Is it taxable?

Yes. It will be taxable as he withdrawn the PF amount before 5 years.

Query-3: When PF Account becomes dormant?

If you do not contribute to PF amount for continuous 3 years, then after 3 years your PF account will be dormant and it will earn interest up to 3 years only.

Query-4: Can we show PF withdrawal amount during Income tax return filing and can we claim for refund of TDS on EPF withdrawal before 5 years?

Yes, you can include PF withdrawal amount in Income tax return filing if you have withdrawn before 5 years. Then Employer’s contributed amount and interest will be taxable as per TDS on Salary rule and TDS on interest rule respectively. And interest on Employee’s contribution amount will be taxable and only employee’s contribution amount will be tax exempted. So during filing of IT return, fill everything in proper section.

If you have included PF withdrawal amount in IT return file then you can also claim for refund of TDS on withdrawal amount according to Income Tax Act.

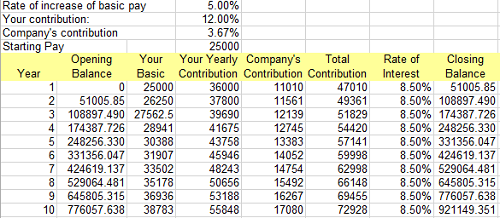

Query-5: How EPF and rate of interest has been calculated?

Check below image:

Hi

I joined a company in 1999 and worked till 2013. THen I moved to a new company from 2014 to to 2015. I served a third company for 3 months in 2015 after which I left work. I recently applied for Full withdrawl using UAN and 90% of the balance was transferred . On raising a grievance that TDS should not be applicable I got a reply that Form 15G/15H were not submitted with the claim form. This is extremely confusing since my service tenure (continuous) is 16 years and no TDS should be deducted. I have raised another grievance but need clarity on how to proceed if I get the same reply.

If you do not submit Form 15G/H with claim forms. TDS has to be deducted. Now you claim it only with IT Office..

Hi,

Please have look in my case, and suggest accordingly.

Info :

Contribution towards my first PF account by my first Employer was made from 12/2012 to 06/2014.

After leaving my first job my second employer contributed in same UAN and new account number form 06/2014 to 03/2016

After that my second employer closes its business in India and all employee were fired.

so, after 03/2016 no contribution is made in my PF account.

Ques:

1. Can I withdraw full amount?

2. Please tell me withdrawal amount is subjected to tax (TDS) or not, If yes rate of Tax?

Thanks & Regards

Mahendra

1. Yes you can withdraw.

2. No TDS in case of establishment closed.

Thanks for replying.

The letter i received from company says that to manage its business the company has decided to optimize its operations. Although the company was planning to terminate its operations but the same was not reflected in the letter provided to me. Later on the company closed its operations.

Please suggest

Do i need to submit any document as a proof of company closing its operations along with FORM 19(UAN) , form 10C(UAN) & cancelled cheque for PF withdrawal ?

Regards

Mahendra

Yes supporting documents would help..

I am a retired employee from central PSU & getting prnsion from EPFO office, Meerut. While filling on-line Income Tax return, it ask for TAN No. of the organisation, which is not available on their website. Kindly help.

RAJAN GUPTA

Download #Pension Payment Heldesk Android App and get your Pension related Problems resolved quickly..

Hi,

Please have look in my case, and suggest accordingly.

Info :

Contribution towards my first PF account by my first Employer was made from 03/2009 to 04/2015.

After leaving my first job my second employer contributed in same UAN and new account number form 04/2015 to 03/2016.

After that my second employer closes its business in India and all employee were fired.

so, after 03/2016 no contribution is made in my PF account.

Ques:

1. i want to withdrawal of all my money from both accounts. Is this possible?

2. tell me this amount is subjected to tax (TDS) or not, If yes rate of Tax?

3. If all amount is withdraw then my UAN still continues or close?

4. How much time required for getting money if all formalities completed?

Thanks & Regards

Lokesh Sharma

1. Yes you can.

2. No TDS

3. Continues

4. 30 working days max..

Thanks for reply.

how to withraw my PF balance..

suggest me..pls

Submit relevant Claim Forms duly attested by your ex-employer. No need for attestation if you have your UAN activated and linked to Bank Account & Aadhaar Card.