Universal Account Number (UAN)

Every employee who has a PF Account he is issued a PF Number which he/she use to track his provident fund details. This account is associated with employer of the firm. Whenever the employee changes the job he is issued with a new PF Number which is associated with new employer. Now every time the person changes his job he gets a new EPF number. To get all these accounts balances at one place he has to request EPFO to transfer funds from previous PF account to current PF account. It had been a big problem and handling transfer claims with multiple PF account numbers.

To solve this problem of multiple accounts Employees Provident Fund Organisation launched a service which involves Universal Account Number in October 2014. Under his UAN the employee can a=handle all his PF accounts under one platform.

What is Universal Account Number (UAN)?

UAN is a 12 digit number issued to every employee who is contributing towards Employees Provident Fund and this number reduces the role of employer in handling EPF account. The Employee has many facilities once he successfully registers for UAN. Following are the benefits of registering for UAN.

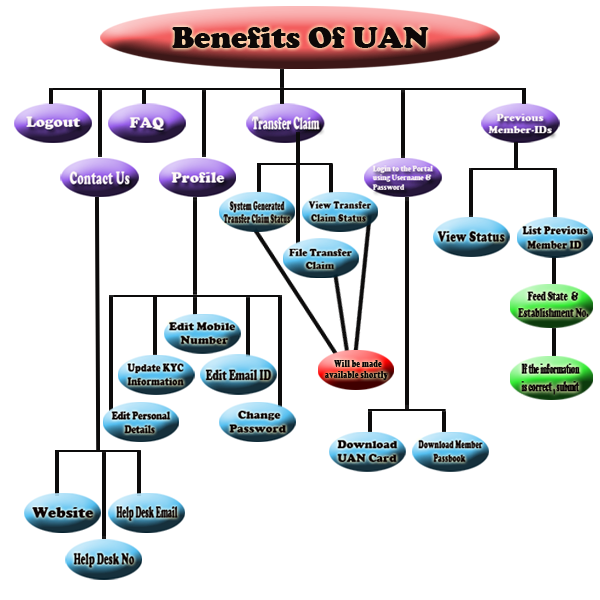

Benefits of UAN

- Easily Download and Print EPF e-Passbook anytime and anywhere

- Easily Download and Print UAN card anytime and anywhere

- Easily connect all his PF accounts current as well as previous at one place

- Update your KYC Information

- Transfer claims can be filed and tracked from the account

- Enter or Edit Nomination details in your EPF account

- Check EPF balance

Difference between UAN and EPF Number

When any employee wants to contribute towards employees provident fund the employer registers him with EPFO and opens an account for him with EPFO. The employer then deposits money on behalf of employee in that account. This number is known as EPF number of that employee. When the person changes his job the new employer will get a new PF number issued from EPFO for that employee. So this way there will be as many EPF numbers as many jobs the person has changed.

UAN as the name suggest is universal account number. It will remain same for the employee as many jobs he may change. Rather it will include all your PF numbers. Whenever the employee changes his job his UAN will not change and his new PF Number will be linked to UAN number.

We can understand it like PAN Number and Bank account Numbers. We can have multiple bank accounts and each will have a different account number but PAN number will be same in all accounts.

Benefits of UAN (Universal Account Number)

- Transfer of Funds from previous account to current account was a difficult process. With introduction of UAN the process has been simplified a lot. Employee has to get his UAN and KYC details verified from new employer and all his previous accounts will be transferred to current account.

- To withdraw EPF balance the employee has to get the withdrawal request signed from previous employer. With introduction of UAN all old account balances will be transferred to current account, so there will be no need of verification from old employer.

- You can easily check EPF balance by downloading e-Passbook. SMS facility available. You will receive SMS when the employer (employer and employee contribution) deposits funds in your PF account.

- The process of claim filing and checking has been simplified a lot with introduction of UAN. Now the employees can easily keep a track on their funds. The EPF and EPS balance from previous employers is also transferred to current account.

How to get Your Universal Account Number (UAN)

EPFO allot UAN to every PF contributor. The UAN detail of all the employees is provided to the employer by EPFO. The employer has to download UAN details and provide it to the employee. The PF member can check whether the Universal Account Number has been allotted to him or not the window below. He has to enter his Provident Fund Account Number Details to check if UAN has been allotted or not.

Change of Job and UAN

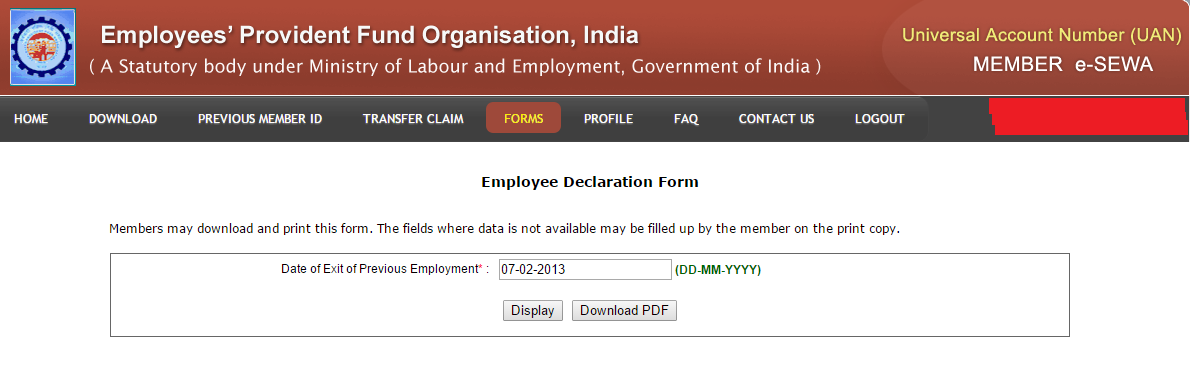

When PF contributor changes the job and wants to continue contributing towards PF with his new employer then he has to provide his UAN to current employer. He also has to submit form 11 (which he can download by logging in at member portal of UAN. (link UANmembers.epfoservices.in ). This form includes previous employer details and declaration from current employer. If employee does not have details to be filled to download the form he can download the form from here and fill it.

Duplicate Universal Account Numbers for same PF Contributor

Many people have got 2 UANs because of unawareness. It may have happened if previous employer has already got UAN for the employee and current employer did not ask for the old UAN and a new one is generated. In this case the employee can reach EPFO directly or through the employer. The old UAN in this case will be cancelled and new one will be valid and you will have to get all your previous PF account balances can be transferred to new UAN. The whole procedure may take some.

Check EPF UAN Card Sample!

my pension no got from 1 1 2016. name m.arumugham ppo AP/KKP/12246.IS UAN MUST FOR PENSIONERS

No UAN is not for you..

Namitha.v mb:9738509070 pf no: NE/GHY/1011420/9 i claimed for pf withdrawal in the month of jul still i didnt get any msg . I wants to know pf claim status n UAN number.

UAN No is Mandatory Now! You should download this Android App EPF Balance UAN e-Sewa and get your UAN Registered and avail all facilities…

No records found in online database for your claim form submission! It simply means either you are telling wrong PF A/c No or your claim forms still haven’t been submitted to PF Office. Where did you submit them? Do you have Acknowledgement Slip?

Sanja yadav

PF No. HR-26923-37

8587090393

What is your query? UAN No is Mandatory Now! You should download this Android App EPF Balance UAN e-Sewa and get your UAN Registered.

BIMALKANTA DWIVEDI,9238812612,OR/BBS/0012457/000/0001235

STATUS for Member ID: OR/BBS/0012457/000/0001235

Your Account has been marked as In-operative Account. For details please contact respective EPF Office.

NAME – Griffen Fernandes. MOBILE – +919819946316.

PF A/c Number – PYBOM00468320000012400

CLAIM FROM 19 & FORM 10C IS RECEIVED GOT A TEXT MESSAGE TOO… BUT AMOUNT IS STILL NOT CREDITED.. when n how much will get credited…

Please reply to your originally opened thread so that we can check our previous conversation. You are not allowed to open multiple threads and it is mentioned on query box. Is it really so hard to keep communication at one place or do you think we can remember all our communication with each and every member? You just have to click on Check box below Query box and you will be Notified of new comments via email.

Member id : kn/46411/377

In spite of written in query box, still some people forgot to mention mobile number.

DEBASHIS DAS,09681005948,MH/BAN/38660/0000150

STATUS for Member ID: MH/BAN/0038660/000/0000150

Your EPF balance has been sent through SMS on your specified mobile number. You shall receive the SMS shortly.

Singavarapu pydiraju 9312372844 ds/nhp/0940150/000/0000513

Member name mismatch against this DS/NHP/0940150/000/0000513

0010477/000/0000164

Hello, Please check your PF No. Please Provide us Provident Fund Number in Proper Format with Mobile No..

Palguna 8553006011

Hello, Please check your PF No. Please Provide us Provident Fund Number in Proper Format..

Sunil Babasaheb Paik 9503476229.MH 915650029315

STATUS for Member ID: KD/MAL/0091565/000/0029315

Your EPF balance has been sent through SMS on your specified mobile number. You shall receive the SMS shortly.

dear madam,

I had recently applied for my PF withdrawal through my previous employer. I have received the payment but less than my actual amount. I would like to know if there is any way i can get the detail of payment received.

Please contact respective EPF Office.