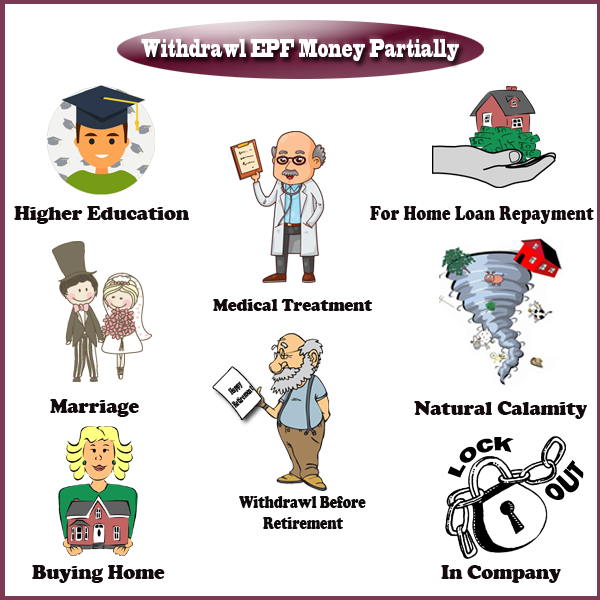

If you need some money from your EPF during the time you are working can you get it? Yes, you can get a nonrefundable loan from your Provident Fund. This is your money which you can withdraw partially during your job. There are certain conditions under which you can withdraw money from your EPF account partially according to EPF Law.

I will never suggest you to withdraw money from your employer provident fund account until you have no source left. This should be your last alternative. It is also not easy to withdraw money from EPF account. EPFO go through your application thoroughly and check its genuineness. There is a long waiting period and EPFO may not approve your application if they find anything crappy.

This should be done only when you need it most as this is your retirement fund which will help you when you are not in a position to work. Now even if you need it then let me explain you the conditions under which you can withdraw your EPF partially.

When you can apply for Advance or Non Refundable Loan from Provident Fund?

Higher Education – You can take a nonrefundable loan from your EPF for higher education of yourself or blood relations (Son, Daughter, Brother and Sister). You can get loan for education purpose only in following conditions.

- Completed 7 years of service.

- Can withdraw up to 50% of EPF balance.

- Can take this loan maximum 3 times in your lifetime.

Marriage – You can withdraw EPF partially under para 68(K) EPF and MP act 1952 while working for marriage of yourself or blood relations (Son, Daughter, Brother and Sister) under para 68(K) EPF and MP act 1952. You have provide adequate supporting document to take this loan. It may a marriage invitation card. Nonrefundable loan for marriage is allowed under following situations.

- Completed 7 years of service.

- Can withdraw up to 50% of EPF balance.

- Can take this loan maximum 3 times in your lifetime.

Buying Home/Plot/Construction – Making an own home is dream of everyone. It needs a lot of funds. But before withdrawing EPF for this should be given second thought as it is you retirement money. In case still you want to take loan for buying a home under para 68(B) EPF and MP act 1952. These points are to be noted:

- You must have completed 5 years of service.

- Property you are going to purchase or constructing should in your own name or in spouse name.

- There should not be any joint holder in that property except you and your spouse.

- You can take this loan only once in lifetime.

- You can withdraw up to 36x (Basic Pay + Dearness Allowance) in case of buying a home or construction.

- You have to submit form 31 form for this.

- You can withdraw up to 24x (Basic Pay + DA) in case of buying a plot.

- You have to submit purchase agreement also in case you are buying.

- You can withdraw up to 12x (Basic Pay + DA) in case of alteration or addition in old house.

- This alteration can be done only after 5 years of construction.

- In case of repair of home you have to wait for 10 years after construction.

For Home Loan Repayment – You can apply for partial withdraw of EPF only after 10 years of completion of service for Home Loan Repayment.

Natural Calamity – In case of natural calamity there is not much rules except you can withdraw under para 68(L) EPF and MP act 1952 only up to 50% of the employer contribution. You have to provide proof of damage too.

Medical Treatment – Medical treatment is a costly affair these days. Under para 68(J) EPF and MP act 1952 you can withdraw your EPF before retirement. However these points are to be kept in mind when applying for loan for medical emergencies.

- You can take loan for treatment of yourself, spouse, son, daughter or parents dependent on you.

- The patient should have been hospitalized for more than one month.

- If you are applying for loan for yourself you should be on leave from company.

- Following are the diseases for which you can take loan for medical treatment: Tuberculosis, Leprosy, Paralysis, Cancer, Heart Disease (No hospitalization Required) & Mental Disorder.

- You can withdraw up to 6x (Basic Pay + DA).

- You can take loan for medical treatment any number of times.

- You have to provide proof of medical treatment from specialized doctors or hospital as required.

Lockout in Company – In case the company you are working with is unable to pay your salary you can use your EPF to fulfill your daily needs, but it is not advised as it will only finish your retirement money. In case it is required then you can withdraw your EPF under para 68(H) EPF and MP act 1952 in following cases.

- Your salary is not paid from 2 months and company is closed from minimum 15 days.

- You can withdraw up to (Basic Pay + DA) not paid. The amount of employee contribution should be equal to more than the amount you want to withdraw.

- In case the company is closed for more than 6 months you can also withdraw employer contribution. I think this situation will not come as you will join somewhere else before that.

Withdrawal Before Retirement – In case you want to withdraw your EPF before retirement you can do so under para 68(NN) EPF and MP act 1952 before 1 year of retirement. Following points to be considered for pre-retirement withdrawal.

- You can withdraw up to 90% of EPF.

- Your age should be more than 54 Years.

- You have to produce certificate from your employer regarding your date of retirement.

How can you apply for Advance or Non Refundable Loan from Provident Fund?

Submit Form 31 duly attested by your employer and submit to concern PF Office along with adequate supporting document to take the advance from PF.

No need for employer attestation if you have your UAN Activated and linked to Bank Account & Aadhaar Card. In this case Submit New Form-31.

Nisar uddin ansari 8873799812 JHRAN003012700000000109

Member name mismatch against this JH/RAN/0030127/000/0000109

Balram mishra

8874855276

Hello, please check your PF No and provide us Provident Fund Number in Proper Format..