The employees, who have been contributing towards EPF account from their salary, may need to withdraw amount after leaving the job. If the employee withdraw EPF amount on or after 5 years and the total withdrawal is less than 30,000 INR, then there will be no TDS deduction on that money. But, if the employee withdraw EPF amount before 5 years and the amount is equal to or greater than 30,000 INR ], then the TDS will be deducted at source. However, TDS will be exempted in some cases also. Read Official TDS on PF Withdrawals Circular!

Is it compulsory TDS deduction on EPF Withdrawal amount before 5 years?

No. The TDS is not compulsory for all situations during withdrawal of EPF amount before 5 years. Let’s discuss some situations on which TDS won’t be applicable.

- 5 years can be counted including job period of 2 or more companies.

If an employee has opened PF account in previous company before 2 years and now he has been using the same PF no. in the existing company since last 3 years. Now, he needs to withdraw PF amount then your withdrawal amount will be TDS exempted because your EPF account has achieved 5 years.

For example: You have started an EPF account with your existing Employer in the Financial year 2015-16 and within 2 years your balance PF account is INR 30, 000/- in F.Y. 2017-18 and now you joined a new company and keep alive the same PF account with new company using UAN. Now, in new company, if you work for next 3 years than your PF account has completed 5 years in F.Y. 2020-21 and whatever granted amount you will withdraw will be tax exempted.

- Special cases such as ill health of employee

If the employee got serious illness and need money for treatment including insurance claim amount and the employee has opened PF account for 2 years only, then he can withdraw the balanced amount in PF account before 5 years with Tax exemption facilities.

- Business discontinuation of employer.

If the employer become defaulter or looser or business has been ceased by any Govt. department such as income tax or excise or quality control or Environment and pollution control department, then the employee can close the PF account and can withdraw the all balanced amount before 5 years with tax exemption facilities.

- If employee changed the job and transferred the balanced amount of existing EPF account to new EPF account of new company.

When the employee resign from the current job and join new company, he can close existing PF account no. and transfer the balanced amount to new PF Account no. maintained by new company. In this case, the transferred amount will be tax exempted and the service from previous establishment will be counted.

How many types of Provident funds available?

There are 4 types Provident funds available such as Statutory PF, Recognized PF, Unrecognized PF and Public PF.

- The Statutory PF was formed under PF Act, 1925 and this PF was maintained by Govt. and semi Govt. organizations, recognized education institutes, railways, universities, etc.

- The Recognized PF was formed under EPF and Miscellaneous PF Act, 1952. This is widely known as Employees’ Provident Fund and is applicable to organizations having 20 or more employee. And also the organizations having less than 20 employees can open PF account for their employees, if interested. The deposited amount of 12% on salary is exempted from Tax under section 80-C.

- The Unrecognized PF is not coming under 80-C and not recognized by commissioner of income tax. Here the employer’s contribution amount towards employee’s PF account is taxable.

- The Public Provident Fund (PPF) is established for beneficial of general public. Any public whether employee of company or self-employed person can participate in this PPF scheme. It is one of the beneficial income tax exemption schemes for all citizens of India.

Query -1: I joined a company on 15th August, 2009 and resigned from the company on 31st July, 2014 for any emergency situation. Further I could not continue job as well as EPF contribution, then if I withdraw PF amount, is it taxable?

Yes, it is taxable and if you don’t want it taxable, then you have to join with any company within next 3 years and complete the 5 years of PF account by contributing more PF amount from salary for 15 days and then your withdrawal amount will be tax free and your PF amount should be recognized by Commissioner of Income tax.

Query-2: Ramesh was working with Reliance Company for last 2 years from January, 2012 to December, 2014. Now he has resigned from that company and he wants to withdraw the PF amount. Is it taxable?

Yes. It will be taxable as he withdrawn the PF amount before 5 years.

Query-3: When PF Account becomes dormant?

If you do not contribute to PF amount for continuous 3 years, then after 3 years your PF account will be dormant and it will earn interest up to 3 years only.

Query-4: Can we show PF withdrawal amount during Income tax return filing and can we claim for refund of TDS on EPF withdrawal before 5 years?

Yes, you can include PF withdrawal amount in Income tax return filing if you have withdrawn before 5 years. Then Employer’s contributed amount and interest will be taxable as per TDS on Salary rule and TDS on interest rule respectively. And interest on Employee’s contribution amount will be taxable and only employee’s contribution amount will be tax exempted. So during filing of IT return, fill everything in proper section.

If you have included PF withdrawal amount in IT return file then you can also claim for refund of TDS on withdrawal amount according to Income Tax Act.

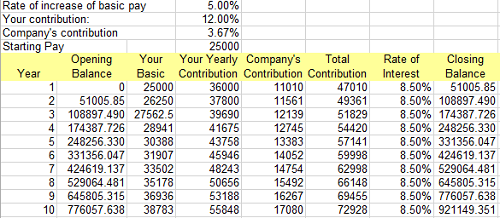

Query-5: How EPF and rate of interest has been calculated?

Check below image:

Hi, I received my PF amount today and observed that there has been 10% TDS deduction on the total amount despite filling form 15G. I tried to see if this deduction is reflecting on 26AS and it is not. Does it take time to update on 26AS?

Yes, it takes time to reflect..

HI,

I left the organization in 2006 and applied for transfer through my current employer but didn’t happened on time and i am not followed up after that. I wanted to know the balance and process to withdrawn the amount as i am not able to link this to my current UAN.

PF: MH/93056/61

For the process to withdraw from inoperative accounts or for any other query Dowload Inoperative Accounts Help Desk Anroid App and get your problem solved quickly! Thanks!

Hi Sonia Mam my self arvind singh my p.f account no-MH/BAN/0127373/000/0002529. I Have deposit pf clearing from in employer office on 18/06/2016 but they have no any response to me

Kindly raise your Grievance here at our Android App to resolve faster..

What percentage deduction from my amount to be paid by me.if withdrawal before 5 yr

30%

Hi,

Myself Pramod,Applied for withdrawal of PF three months ago and submitted documents in last week received amount less almost half of it than what being displayed in UAN status.

Emp ID : GB122048

UAN : 100044397483

PF No :KN/WF/45573/10784

Thanks,

Pramod

Kindly raise your Grievance here at our Android App to resolve faster..

what a reject my epfo staters

What???

TDS not updated in 26 AS:i have withdrawn my PF in october 2015.But TDS deducted is not reflecting in the 26AS.

Member ID/Name

MH/BAN/45665/89093/ SUDHAKARA CR

Kindly raise your Grievance here at our Android App..

I tried app it is not working

Kindly try after some time..

Devarajan.G

PF Acc no: TN49743/333

Mobile: 9842497330

Can i send PF claim form through post to Royapettah office..? or submit in any regional offices.?

Better to submit directly at Chennai Office..

Hi,

My name is Shalini

I would want to know if during withdrawal, will the employee contribution and employer contribution in full can be withdrawn.

While I check my balance, I see there is a difference in employee value and employer value, which might be Provident fund. but will I be able to withdraw all the value?

Yes you can withdraw full amount. Submit relevant claim forms duly attested by your ex-employer.

Read the Form filling instructions here and here carefully.

To understand difference in employee contribution and employer contribution check here.

I didn’t understand.

I know the breakup of Employer contribution.

My question is if I can withdraw EPS also if I am not at the age of 58 or will it be blocked.

Yes you can withdraw it if your total service tenure is less than 10 years..

Hi,

I have another query on AP/HYD/0037897/000/0017049 which is my PF account from my previous organization which I left in July 2006.

Want to know if I have transferred the PF or did I withdraw?

The process to withdraw from inoperative accounts has been explained here! Thanks!

UAN No is Mandatory Now! You should download this Android App EPF Balance UAN e-Sewa and get your UAN Registered.

what if I withdraw my PF in the middle of financial year. Will the Interest be calculated as pro-rated or will I not get any interest for that year.

Interest is calculated on monthly basis.

Hi Madam, This is G.Karpagam. I relieved from existing company in Tamilnadu dated 20/11/2006. i didn’t receive my PF amount. My PF number is 32499.

Hello, Please check your PF No. Please Provide us Provident Fund Number in Proper Format..

Hi,

My PF account #BG/BNG/0026858/000/000585

Shalini Battula

Can you tell me the exact PF value as the records are updated only till Mar’15.

Regards,

Shalini

You should download this Android App EPF Balance UAN e-Sewa and get your UAN Registered.

Hi,

My name is Shalini and want to know if I can withdraw my PF.

I have worked for 9 years in my previous organization and resigned in Sep’15. I have submitted for PF withdrawal now after 2 months of resignation.

What is the TDS deduction if withdrawn?

What if I am employed. can I still withdraw?

Regards,

Shalini

You can only withdraw after leaving the job. TDS Deduction can’t be calculated earlier.

Hi Anu.,

I am Kiran Yolarotti, I have joined a new company recently and the new PF allocated is attached to my UAN. I want to withdraw the amount closing down the PF account – this account also contains my previous PF transferred. would it be taxable?

Previous PF (transferred to new) : 4 years 6 months

new PF : 1 years

Please let me know if the amount would be taxable

Best regards

Kiran Yolarotti

Yes it would be taxable but exact amount can’t be calculated now.

Please confirm my pf for are submitted or not.

My PF Account Number :- MH/90289/463

UAN NO-100222253254

Not sowing current status

Mb.no-9639555689

STATUS for Member ID: KDMAL00902890000000463

No records found in online database for your claim form submission. Where did you submit them? Do you have Acknowledgement Slip?

prabhat ranjan;9893027463;06478128

What is this? Have you heard about use of space bar button? What do you want to know? Where is your PF No. Please Provide us Provident Fund Number in Proper Format..

Hi Team,

Can you please let me know what will be the tax deducted if i withdraw

my previous company’s pf amount as i have only completed 2 years 10

months there .It shows my previous employer has uploaded my PAN

details but verification status is pending in epfo site . Please find

the attachments for your reference .

Can you please let me know whether my PAN is submitted or i do have to

submit .

Total Work Exp:- 3 years 4 Months

Previous Company – 2 Years 10 Months

Joined new company one week after leaving the previous company

Haven’t transferred amount from my previous pf account to the new

company’s pf account. Please correct me if I am wrong with below calculation on which my TDS might be deducted :-

Total amount = Employer Share + Employee Share + Pension Contribution = 1.1L p.a

UAN -100123584607

PF A/c No- PYKRP00192140000171053

Thanks,

Gopinath

If your total service is 3 years and 2 months and you want to withdraw PF than your TDS will be 10% at Total amount = Employer Share + Employee Share + EPS + Interest..

Thanks for the reply …!!! 🙂

One query still needs your advice ….

UAN -100123584607

PF A/c No- PYKRP00192140000171053

Do i need to submit PAN again as it shows that PAN is in pending verification status which was submitted by employer .Does that mean i can just send the filled up forms 19 and 10C my previous employer.

Attach your Pan Card and Form 15G along with Form 19 & 10C when you want to withdraw..

Thanks alot . Is it mandatory to provide bank account which was linked to my PF . Can i provide a new bank account details.

For point no 12 in form 10c ,related to EPS , i am not sure what PPO No is ?

You can give any bank details. Just attach a cancelled cheque. Leave that point.

As per the latest changes in form 15g , we have to specify total income + pf amount for 2015-2016 which is around 5.8L in my case and i am also currently working in a new organization . So am i eligible to submit form 15g and withdraw Pf respectively .?

You have to submit F-15G with withdrawal forms..

sir i am k ganesh chary i am from hyderabad i was submiited my pf in march but still not confirm through mobile or through email and my pf number is 0028146393 my office was in indore MP plz confirm me wether my pf process are going on or not plz confirm my mobileno- 07386782062

Hello, Please check your PF No. Please Provide us Provident Fund Number in Proper Format..

Dear Sir/Mam,

Kindly provide my PF status

PF NO- MH/41618/0007993

Kindly help.

Regards,

Raviraj.

8878328348

STATUS for Member ID: MH/BAN/0041618/000/0007993

Your EPF balance has been sent through SMS on your specified mobile number. You shall receive the SMS shortly.

HELLO, PLEASE I AM A LOW SALARY PAID EMPLOYEE, WORKING FROM MORE THAN 6 YEARS BUT WANT TO KNOW, HOW I CAN GET MY FULL PF AMOUNT WITHOUT ANY DEDUCTION i.e. TDS OR ANY TAXES, I AM ALSO NOT ELLIGIBLE FOR TAX PAYING

Submit relevant claim forms duly attested by your ex-employer.

Read the Form filling instructions here and here carefully.

Sir,I recently applied for pf transfer my previous account PY/PNY/19496/6638 to present account PY/KRP/35797/5408.Please clarify is it mandatory to upload cancelled cheque leaf on my UAN KYC information to tranfer pf amount

Yes it is mandatory.

i am rangappa.b applied pf withdrowel form on hubli pf office before 45days but not showing amount my bank acount whats is the proble plz information me pf.no GB/HBL/0063142/000/0030 Mobile no 8105325375

I hope you understands English! You have been replied here and here and here already.

Please reply to your originally opened thread so that we can check our previous conversation. You are not allowed to open multiple threads and it is mentioned on query box. Is it really so hard to keep communication at one place or do you think we can remember all our communication with each and every member? You just have to click on Check box below Query box and you will be Notified of new comments via email.

Can I withdraw my PF amount deducted by one employer even I joined the new job.

Yes you can if you don’t have UAN.

Hi Sonia nice to see your initiative.I want to withdraw my E.P.F which is near around 40 grands and I have a service of 2 years ( I am not working now) . My gross salary is 2.9 L.P.A but my net salary was less than 2.5 L.P.A. Am I eligible to submit form 15 G with that salary.Would I be attracting 10 % deduction on my pf withdrawal if I submit form 15 G with the mentioned salary. For both the years I worked I had the same salary.

Yes, you have to submit Form 15G and Pan Card Copy.

I know that, but am I eligible to submit form 15 G as my gross salary is above 2.5 lakhs ie. 2.95 but my net income is less that 2.5. Can you give me some clarity on that?

If your PF amount crosses rs 30000 and your service is less than 5 years than you have to submit it.

Dear Anu Dey,

Please can you update me about my PF status and my PF balance,

before 2 years i apply for my PF but its reject b’coz due to some problem in name so now what i well do for my PF,

My privies company say now you apply online for PF,

but how can i apply online i dont have any about about that so please give me some instruction what i do now.

My PF Account Number :- KN/46294/50966

Regards

Muaaj Dhuma

7666613311

EPFO has made a provision for change the name of EPF members in the application software. Members who wish to get their name to be changed in the EPF Database can apply for the same through their employer along with supporting documents like Voters ID or Pan Card. A joint request of Employer and Employee is needed.

Hello I want to add more amount to my pf account by duducting my slalary on monthly basis how it is possible and what is the maximum limit that can i go for it.

thanks in advance

You can go up to full basic but your employer is only bound for 12%.

Shankar kumar mobile 8130453673 pf a/c 450

Hello! This is not PF Number. Please Provide us Provident Fund Number in Proper Format..

What is the PF limit, Suppose one employee Basic salary is 100000 per month, as per PF act Employee contribution is 12%. i.e 12000, What is the PF limit

The employee can pay at a higher rate from wage ceiling of Rs 6500 but employer is not under any obligation to at a higher rate..